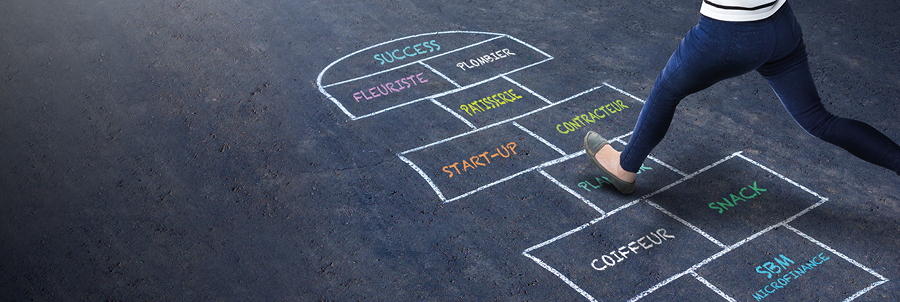

Nou aide ou dibout lor ou prop lipié

SBM Microfinance connects with small entrepreneurs with annual turnover less than Rs10M, in order to accompany, support and assist them to access specially designed financial products and services and become self-employed income earners.

SBM Microfinance offers financial solutions to small entrepreneurs who are not catered for by the mainstream banking system due to lack of collateral or low value of available collateral. We thus create wealth at the bottom of the pyramid and empower them to become financially self-sufficient and gradually stand on their own feet.

Requests for Microfinance credit facilities ranging from MUR 15K to MUR 1M are entertained along competitive and flexible criteria that take into account the specific requirements of Microfinance customers.

Overview of Products and Services

|

Products |

Key design/ features |

|

Working Capital finance* |

Short term capital on revolving basis to meet working capital needs such as purchase of raw materials or building stock of goods through import /local purchase |

|

Micro investment loan* |

Term Loan to meet capital expenditure (acquisition of business premises, interior set up, tools etc.) Relatively longer tenor can be considered based on merits /collateral applicant can offer/ cash flow trends |

|

Assets acquisition facility* |

Purchase of vehicles/productive assets facilities. (machinery and equipment) to help enterprise improve both quality and quantity of production. |

|

Leasing facility* |

Basically to acquire on lease vehicle ( van/cars/lorry/mini bus) needed for business purposes. |

|

In-house micro insurance service/product |

SBM, through its subsidiary SBM Insurance Agency Ltd, offers micro insurance products/services especially designed to mitigate different types of risks, such as agricultural/ health/theft/cattle disease/flood/life cover of entrepreneur, etc. |

* Tenor of up to 7 years

Envoye ou nom ek ou numéro telephone par SMS lor 52578763. Lékip SBM Micro Finance pou reprend contact avec ou.