At a glance

Wherever you are and whenever you want, your VISA Classic Debit Card, UPI and MasterCard allow you to access your funds and to pay for your purchases as well as other transactions with the ease and convenience of not carrying cash.

What is a contactless card?

Contactless allows you to make faster and secured low value payments by tapping your contactless-enabled bank card on a payment terminal without inserting your card into the payment terminal or entering your personal identification number (PIN).

How to make contactless payment?

Contactless payment can be effected at any merchant’s payment terminal bearing the contactless payment symbol.

![]()

When the merchant’s payment terminal prompts you, you are required to place your card within a few centimeters from the terminal. When the terminal accepts the reading, it signals with a beep, green light, or checkmark. Once the approval is received, the transaction is completed.

Where can I use the contactless card?

Please refer to question 2 above.

The majority of the SBM POS terminals accept payments by the contactless card.

Is there any contactless transaction limit I can use contactless?

The contactless card can only be used for transactions amounting up to MUR 10,000 per day (or the equivalent in foreign currency).

Can I use contactless to get cash out at an ATM?

No, you cannot get cash out of an ATM using contactless.

Are there any fees for paying with contactless?

Besides the standard fees and charges applicable to existing non-contactless card, there are no additional fees associated with the use of contactless service.

Can I use my contactless card abroad?

Yes, you can use your contactless card abroad. Contactless transactions will be accepted wherever the contactless symbol is displayed. Please be aware that the contactless transaction limit of MUR 10,000 (equivalent in foreign currency) may vary depending on the country in which you are transacting.

How can I get a contactless card?

You will automatically be issued a contactless card when your existing card is up for renewal or expiry. You will need to effect an ATM transaction or point of sale transaction to enable the contactless function.

What happens if the terminal is not contactless enabled?

Your card can still function as a regular card for Chip +PIN transactions.

What happens if I must do an online transaction?

Contactless transactions can only be done at physical terminals, which are contactless enabled. Online transactions will continue to be effected on the relevant platforms for online banking.

Is reloading of funds needed for the contactless features?

No, no loading of funds onto the contactless card is needed. The funds will be deducted on your account from the available balance.

SECURITY FOR CONTACTLESS PAYMENT

Could I unknowingly make a purchase as I walk past a reader?

No. The merchant must have keyed in the transaction amount for you to approve first, and your card needs to have been held within a few of centimeters of the terminal. You will also be provided with a RFID (Radio Frequency Identification) protection sleeve to protect your card.

Is contactless technology secure?

Yes. Contactless uses the latest secure encryption technology (same as Chip and PIN) so you can feel confident when using it to pay for items. There is a ceiling of MUR 10,000 on the aggregate value of transactions permitted per day, and from time to time, you may be asked to enter your PIN to verify you are the genuine cardholder. If your card is lost or stolen, please inform our hotline immediately on [230] 207 1111 so that the card can be blocked. You will not be held responsible for fraudulent charges or unauthorized purchases made using the contactless features on your card, after reporting the loss of your card to the Bank.

Why don't I need to enter my PIN or sign for purchases?

This is to ensure that using contactless technology is as simple and convenient as cash; merchants that accept contactless payments do not require you to sign or enter your PIN for transactions under MUR 10,000 (or the equivalent in foreign currency).

- Free of charge

- Chip-enabled providing you with the highest level of card payment security

- Make everyday payments quick, easy and safe with your new SBM Contactless card

- Access your funds 24 hours a day and 7 days a week

- Worldwide acceptance at over 20 million POS (Point of Sale) and over one million ATMs

- Discounts at merchant partners across Mauritius.

- Recharge your mobile phone through SBM TopUp

- Exclusive worldwide discounts for UPI customers.

Upon opening of Current Savings account

1. What is an E-Commerce Transaction?

An E-Commerce transaction refers to the online purchase of products or services paid using a Debit/Credit/Prepaid Card and a CVV (Card Verification

Value) number.

2. Who is eligible for making an E-Commerce transaction with his/her debit card?

All customers who hold a SBM Visa, Mastercard or UPI debit card and who have activated the E-Commerce feature on their debit card(s).

3. How can I make an E-Commerce Transaction?

The customer has to enter the 16-digit card number, the 3-digitCVV (Card Verification Value) number and the one-time-password (OTP), if required, to authorize payment. The CVV is a 3-digit number printed on the back of the Debit Card while the card’s expiry date is printed on the front.

4. Do I need to enter my PIN to make an E-Commerce transaction?

PIN is not required for E-commerce transactions. However, an OTP (One-time Password) will be required if purchases are done on a secured website.

5. Can I Change the CVV number?

No, the customer cannot change the CVV number.

6. What can I do if the CVV Number is not readable on my Debit Card?

The customer is advised to call at any SBM branch to apply for a new Debit card.

7. How will you receive the One-Time Password (OTP)?

On your mobile number or email address registered at SBM.

8. What should I do if I did not receive the One-Time Password (OTP) on my registered mobile number or email address when making an online payment on a Secured website?

- Immediately call the SBM Contact Centre on (230) 202 1256 during business hours (9.00 A.M. to 4.30 P.M. on weekdays) or send an email to customerservice@sbmgroup.mu

- Of note, after business hours, during weekends and on public holidays, call the SBM PRM Team on (230) 202 1256 or send an email to prmteam@sbmgroup.mu

9. What to do if my contact details are not updated to receive the One-Time Password (OTP) or SMS Notification? (Retail/ Private Banking)

- SBM Internet Banking (IB) users can update their contact details on the IB platform itself by following the steps listed below:

- Log in to the IB platform > My Profile > Personal settings to update your contact details.

OR

- Click directly on “Login issue with OTP - Update e-Contact Details” on the IB homepage to change your contact details if you have either a valid

SBM Debit or SBM Credit or SBM Prepaid card.

- Customers who are not registered for the Internet Banking service should call at any SBM Service Unit in person, bringing along their National Identity Card/ valid passport to update their contact details.

For more information, reach out to the SBM Contact Centre on (230) 202 1256 during business hours (9.00 A.M. to 4.30 P.M. on weekdays) or send an email to customerservice@sbmgroup.mu. You may also call the SBM PRM Team on (230) 202 1256 after business hours, during weekends and on public holidays or send an email to prmteam@sbmgroup.mu.

10. What to do if I want to activate/deactivate the E-Commerce feature on my debit card?

For Retail & Private Banking

(1) To proceed with activation/deactivation of E-commerce feature:

- Log in to the SBM Internet Banking platform on Path: General Services > Service Requests > New Requests >Request Type Cards > Activate/Deactivate e-Commerce transaction or

- Log in to the SBM Mobile Banking app on Path: More > Services > Debit Cards > Activate/Deactivate e-Commerce transaction >Type of Card > Select Card Number or

(2) Submit a request via a secured email on the SBM Internet Banking platform for activation/deactivation or

(3) Call at any SBM Service Unit in person, bringing along your National Identity Card/passport, or

(4) Contact your respective Personal Banker/ Private Banker or

(5) Call SBM Contact Centre on 202 1256 during regular business hours (from 9.00 A.M. to 4.30 P.M. on weekdays) to activate/deactivate the

E-commerce feature on your debit card(s) or

(6) Call SBM PRM Team on (230) 202 1256 after business hours, during weekends and on public holidays to activate/deactivate the E-commerce feature on your debit card(s).

For Corporate Banking

(1) Contact your respective Relationship Manager or

(2) Call at any SBM Service Unit in person, bringing along your National Identity Card/passport and all the required documents.

11. Can I increase/decrease my E-Commerce transaction limit?

Yes.

12. What should I do if I need to change the E-commerce limit on my debit card?

For Retail & Private Banking

(1)To adjust the E-commerce limit accordingly:

- Log in to the SBM Internet Banking platform on Path: General Services > Service Requests > New Requests >Request Type Cards > Increase/Decrease e-Commerce limit or

- Log in to the SBM Mobile Banking app on Path: More > Services > Debit Cards > Increase/Decrease e-Commerce limit >Type of Card > Select Card Number or

(2) Call at any SBM Service Unit in person, bringing along your National Identity Card/passport, or

(3) Contact your respective Personal Banker/Private Banker.

For Business/Corporate Banking

(1) Contact your respective Relationship Manager or

(2) Call at any SBM Service Unit in person, bringing along your National Identity Card/passport and all the required documents.

13. How to prevent online frauds on your debit card(s)?

- Check your transactions and account balance regularly

- Always use a secure network when making online purchases

- Only carry out transactions at reputed online stores/merchants

- Never share your card details with others

14. Who should I contact if I encounter any issue related to E-commerce on my debit card or notice any suspicious transaction?

- Immediately call the SBM Contact Centre number on (230)202 1256 during regular business hours (from 9.00 A.M. to 4.30 P.M. on weekdays) or send an email to customerservice@sbmgroup.mu

- You may also call the SBM PRM Team on (230) 202 1256 after business hours, during weekends or on public holidays or send an email to prmteam@sbmgroup.mu

15. What is the default E-commerce limit on my debit card and what is the maximum E-commerce transaction limit that I can set using the SBM Internet Banking platform or the SBM Mobile Banking app (IB/MB)?

16. What should I do if I need to increase my E-commerce transaction limit above the maximum authorised on IB/MB?

You should either visit any SBM branch or contact your Personal Banker/Private banker.

17. What is the maximum E-commerce transaction limit authorised at SBM Service Units?

The maximum E-commerce transaction limit will be determined based on the available balance on the cardholder’s account and subject to approval by Senior Managers/Head of Retail.

Is the Debit Card free of charge?

Yes, except for the replacement of cards or PIN.

How secure is our Debit Card?

SBM Debit Cards are Contactless and chip-enabled which makes the card totally secure. Even if you lose your card all you need to do is call us immediately on our cards hotline (230) 202 1256, available on a 24/7 basis, or on (230) 207 0111 between 08h00 and 18h00 on weekdays and we will cancel your card.

Does a customer need to hold an account with SBM to have a Debit Card?

Yes. A savings or a current account is required.

Can it be used other than on SBM ATMs?

Yes, on any ATM or POS machine worldwide displaying the Visa or MasterCard or Cirrus or UPI logo. However, if used on non-SBM ATMs an interbank fee is payable.

Will the merchant charge me an additional fee for paying with my card?

No, the cost of an item is the same whether you pay by card or cash.

Can it be used if no balance is available in the account?

No, unless there is an overdraft limit on a current account.

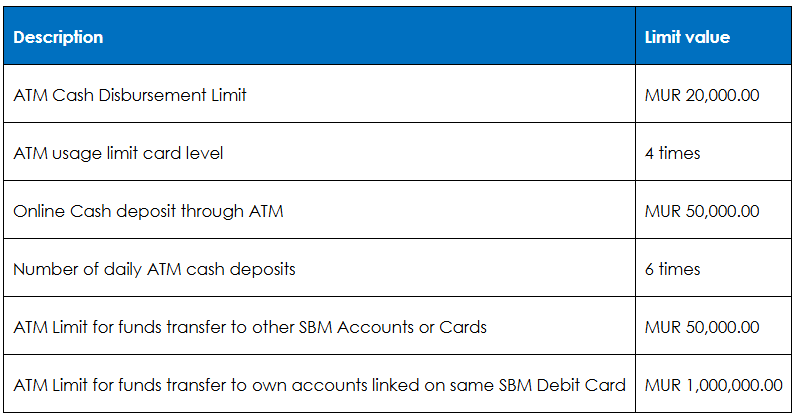

Is there any limit on the ATM withdrawals allowed with an SBM Debit Card?

At any point in time, the maximum amount you can withdraw is Rs 20,000 per day. Moreover, for security reasons, more than 4 ATM transactions on the same day is not allowed.

Can a higher daily withdrawal limit be set on the card?

Yes. A higher individual limit can be considered upon request e.g. when travelling abroad. A written request must be made via any SBM branch.

Can a debit card be used on the internet for online purchases?

Yes, however customer will need to register this option by visiting any SBM Service Unit (For more details, please refer to Terms & conditions, section 8).

Will statements be generated showing all Debit Card transactions?

Yes, the bank will mail customers their statements on a monthly/quarterly basis. Customers having Internet Banking facilities can also view their transactions online and those having Mobile Banking services can view their transactions on their mobile phones.

Can supplementary cards be issued on the same account?

No. However individual cards can be issued to each party of a joint account.

Does the card have an expiry date?

Yes, a Debit Card is valid for 5 years and is automatically renewed upon expiry.

Debit Cards Limits

Essential ATM safety tips for cardholders traveling abroad

1. Whenever possible, use ATMs inside bank branches, hotels or airports rather than outdoor or isolated ATMs.

2. Always cover the keypad when entering your PIN.

3. Do not accept assistance from strangers if the card gets stuck.

4. Monitor your bank account activity regularly through SBM Tag or SBM Internet Banking.

5. If your card is retained by an ATM, block it immediately through SBM TAG or contact SBM on (230) 202 1256 right away.